louisiana estate tax rate

Louisiana has a graduated individual income tax with rates ranging from 185 percent to 425 percent. Under the federal estate tax law.

Louisiana Inheritance Laws What You Should Know Smartasset

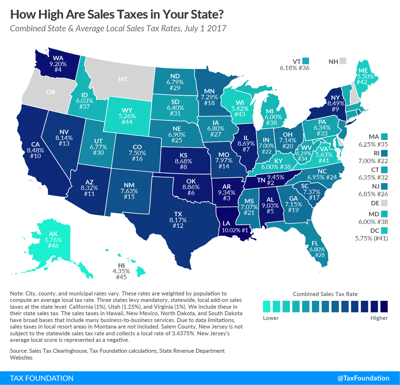

Table of Sales Tax Rates for Exemption for the period July 2013 June 30.

. Rate and basis for assessing property values The rate used in determining assessed value differs depending on the type of property. Louisianas median income is 54216 per year so the median yearly. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

Louisiana Property Tax Breaks for Retirees. It really should not be much of a surprise. Your 2022 tax rate will be.

Louisiana has some of the lowest property tax rates in the US as only Alabama and Hawaii residents pay less on average than residents of the Pelican State. Best Free Tax Software. The following types of property are assess ed based on fair m arket val ue.

FEDERAL ESTATE TAX RATES Taxable Estate. Credit Karma Tax Review. Agricultural horticultural marsh and timber lands are assessed.

Louisiana also has a corporate income tax that ranges from 350 percent to 750 percent. 50000 60. The estate tax rate at the federal level is 40.

The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. There is no estate tax in Louisiana but residents of the Bayou State may still have to pay the federal estate tax if their estate is worth enough. Ad Explore detailed reporting on the Economy in America from USAFacts.

The property tax rates listed below are the average for properties in Louisiana. Gift tax inheritance tax. Because it is so high make sure to reduce your net assets as low as possible to minimize any estate tax liability.

You can look up your recent appraisal by filling out the form below. Average Property Tax Rate in Louisiana. In Louisiana the median property tax rate is 551 per 100000 of assessed home value.

Lowest sales tax 445 Highest sales tax 1295 Louisiana Sales Tax. Visualize trends in state federal minimum wage unemployment household earnings more. On average a homeowner pays 505 for every 1000 in home value in property taxes with the average Louisiana property tax bill adding up to 832.

Most states with no estate tax have no gift tax either. One reason Louisiana has such low property taxes is the states generous homestead exemption which reduces the taxable value of owner-occupied properties by 7500 in assessed value. Actual property taxes may vary depending on local.

Louisiana has a 445 percent state sales tax rate a max local sales tax rate of 700 percent and an average combined state and local sales tax rate of 955 percent. Regenerated Max Mill Reports from 2005-2009 for all parishes except Orleans and Regenerated Max Mill Reports from 2006-2010 for Orleans Parish reflect the data in the current 2010 millage record in the columns entitled Purp - Roll Up. Tax on a 200000 home.

If youre married filing taxes jointly theres a tax rate of 2 from 0 to 25000. Average Sales Tax With Local. Louisiana has state sales tax of 445 and allows local governments to collect a.

The Best Louisiana Property Tax Exemption Advice. Revenue Information Bulletin 18-017. The Economic Growth and Tax Relief Reconciliation Act of 2001 phased out the state estate tax credit between 2002 and 2005 and replaced the credit with a deduction for state estate taxes for deaths that occur.

Is Personal Property Taxable. Tax on a 200000 home. Based on latest data from the US Census Bureau.

Whether you are already a resident or just considering moving to Louisiana to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The Louisiana income tax has three tax brackets with a maximum marginal income tax of 600 as of 2022. The median property tax in Louisiana is 24300 per year based on a median home value of 13540000 and a median effective property tax rate of 018.

Tax on a 200000 home. The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year. However because of the varying tax rates between taxing districts the average tax bill fluctuates from parish to parish.

Louisiana has one of the lowest median property tax rates in the United States with only states collecting a lower median property tax than Louisiana. 2022 List of Louisiana Local Sales Tax Rates. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

The average annual tax on property in the Pelican State is around 795 significantly less than in. Resident ial 10 co mmercial 15 and public service 25. Louisiana also does not have an inheritance or gift tax.

Louisiana Department of Revenue. Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053. Louisiana Property Taxes Range.

Louisiana has some of the lowest property tax rates in the US as only Alabama and Hawaii residents pay less on average than residents of. 9 Caldwell Parish. How to Fill Out W-4.

In Louisiana theres a tax rate of 2 on the first 0 to 12500 of income for single or married filing taxes separately. Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Revenue Information Bulletin 18-019. Yes Louisiana State Website. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Louisiana Property Taxes Compared to the nationwide 107 average effective property tax rate Louisiana has a generous rate at 053. Tax on a 200000 home. The data in the last three columns are actual millage rates from that report year.

Your 2021 tax rate is. It is indexed for inflation and for deaths occurring in calendar year 2020 the exempt amount is 1158 million for an individual and twice that for a married couple. According to the Business Insider reports Louisiana belongs to the states with the lowest property tax rate.

Effective Real-Estate Tax Rate. Tax amount varies by county. Learn all about Louisiana real estate tax.

Detailed Louisiana state income tax rates and brackets are available on this page.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

108 W Atlanta Louisiana Homes Rental Property Home Buying

America S 15 States With Lowest Property Tax Rates House Prices Louisiana Homes Property Tax

Filing Louisiana State Tax Things To Know Credit Karma

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm

Where S My Refund Louisiana H R Block

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

Louisiana Property Taxes By County 2022

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans

Louisiana Inheritance Tax Estate Tax And Gift Tax

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Louisiana Retirement Tax Friendliness Smartasset

Sold In 2022 Getting Things Done Country House Rocklin

Louisiana Property Tax Calculator Smartasset

Louisiana State 2022 Taxes Forbes Advisor

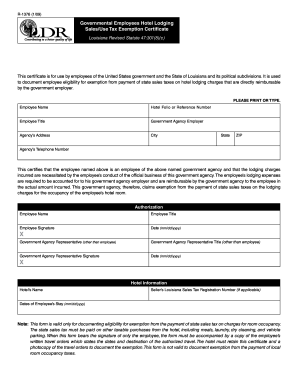

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Tax Changes Take Effect In New Year Biz New Orleans